Living paycheck to paycheck can feel like a constant balancing act. You juggle bills, groceries, and maybe even a bit of fun, all while praying the tightrope doesn’t give way. But fear not, budget-conscious warriors! It’s possible to make ends meet – and even have a little leftover – without feeling deprived. Here are 5 budgeting hacks that will transform your financial tightrope walk into a triumphant stroll:

Hack #1: Embrace the Power of Awareness – Track Your Every Penny

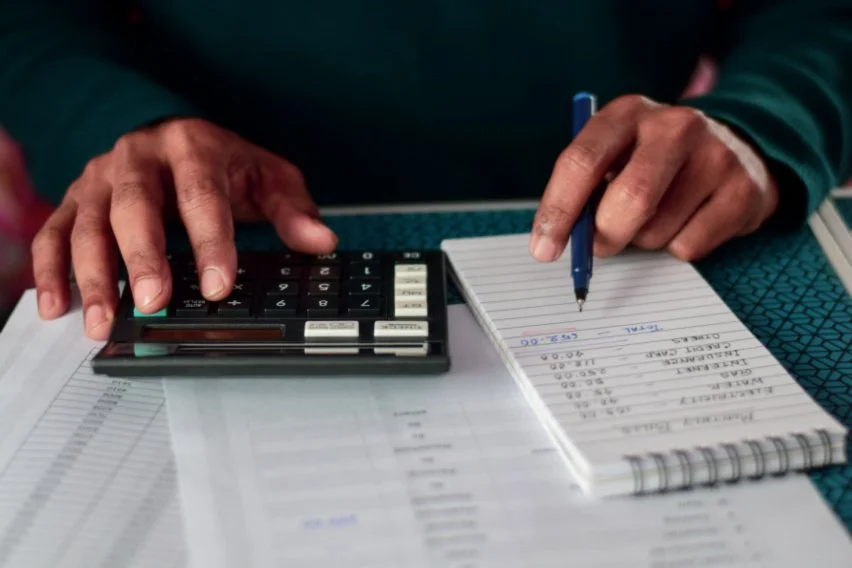

The first step to making smart financial decisions is understanding your current situation. Here’s where tracking expenses comes in. For at least a month, meticulously record every penny you spend. There are two main approaches:

- The Pen and Paper Method: Grab a notebook and divide it into categories like groceries, rent/mortgage, utilities, transportation, entertainment, etc. Note down every expense, big or small, in its corresponding category.

- Digital Tracking: Numerous budgeting apps are available (Mint, You Need a Budget, etc.) that simplify the process. These apps allow you to link your bank accounts and automatically categorize transactions.

This tracking period paints a clear picture of your spending habits. Are you surprised by how much goes towards daily lattes? Do subscriptions you no longer use drain your bank account? Tracking ignites the awareness needed to make informed adjustments.

Hack #2: Prioritize Ruthlessly – Needs vs. Wants

Now that you’re aware of where your money goes, it’s time to prioritize. Separate your needs from your wants. Needs are essential for survival – rent/mortgage, utilities, groceries, transportation to work. Wants, on the other hand, are things you desire but can live without – that fancy streaming service, a new pair of shoes you don’t necessarily need.

Once you differentiate needs from wants, allocate funds accordingly. Ensure your needs are met first, leaving what’s left for your wants. This might mean saying goodbye to some subscriptions or scaling back on dining out.

Hack #3: Embrace the Power of “No” and “Free”

Saying “no” doesn’t equate to deprivation. It’s about being mindful of how you spend your money. Instead of impulse purchases, consider free alternatives. Here are some ideas:

- Entertainment: Libraries often have movie nights, author readings, and other free events. Explore parks and museums with free admission days.

- Physical Activity: Public parks offer free walking/running trails. Online exercise videos provide a cost-effective way to stay fit.

- Learning: Utilize free online courses offered by platforms like Coursera and EdX to expand your knowledge and potentially enhance your freelance career.

Hack #4: Befriend the “Envelope System” for Cash Flow Management

For some people, relying solely on debit cards or credit cards can make tracking expenses difficult. The envelope system provides a tangible approach to budgeting. Here’s how it works:

- Categorize Expenses: List all your essential expense categories (groceries, gas, utilities, etc.).

- Withdraw Cash: At the beginning of each pay period, withdraw a specific amount of cash for each expense category.

- Stick to the Plan: Use the designated cash envelopes for each category. Once the envelope is empty, you know you’ve spent your allocated amount. This method encourages conscious spending and prevents overspending.

Hack #5: Embrace the “DIY” Life and Unleash Your Inner MacGyver

There’s no shame in a little DIY! Before resorting to expensive services, explore DIY alternatives. Here are a few examples:

- Food: Instead of takeout, cook meals at home. Batch cooking on weekends can save time and money during the week.

- Coffee: Invest in a reusable coffee mug and brew your own instead of daily Starbucks runs.

- Entertainment: Host potlucks with friends instead of expensive nights out. Board games or movie nights are budget-friendly ways to socialize.

Bonus Hack: Embrace the Power of “Cooking from Scratch”

Eating out can drain your finances. Cooking from scratch can be healthier, more budget-friendly, and surprisingly, fun! Start with simple meals and gradually expand your skills. Meal planning also helps in staying within your grocery budget.

Remember: Small Changes, Big Impact

Implementing these hacks requires a shift in mindset. But know that even small changes add up. The key is consistency. As you develop smart spending habits and embrace free or inexpensive alternatives, you’ll be surprised by how much you can save.

The Ultimate Goal: Financial Freedom and Peace of Mind

Budgeting isn’t about feeling deprived. It’s about taking

control of your finances and building a secure future. By making smart choices today, you’ll unlock financial freedom and experience the peace of mind that comes with knowing you’re in control. Here are some additional tips to help you on your journey:

- Set Financial Goals: Beyond making ends meet, define your financial goals. Do you want to save for a vacation? A down payment on a house? Having clear goals provides motivation to stick to your budget.

- Celebrate Your Wins: Recognize your progress and achievements, no matter how small. Reaching a savings goal or sticking to your budget for a month is something to celebrate! Reward yourself with a non-monetary treat, like a relaxing bath or a movie night.

- Seek Support: Talk to friends or family members who are good at budgeting. Consider joining online budgeting communities for support and tips. There’s no shame in asking for help!

- Review and Adapt: Don’t expect your budget to be perfect from the start. Review your spending habits regularly and adjust your plan as needed.

Building a Sustainable Budget Lifestyle

Remember, budgeting is a journey, not a destination. It’s about developing sustainable habits that allow you to live comfortably within your means. By incorporating these hacks, setting clear goals, and celebrating your progress, you’ll transform your financial tightrope walk into a confident stride towards a secure and fulfilling future.

Bonus Content: Budgeting Apps and Tools

Technology can be a powerful budgeting ally. Here are some popular budgeting apps to consider:

- Mint: Provides a comprehensive overview of your finances, including budgeting, bill pay, and investment tracking.

- You Need a Budget (YNAB): Emphasizes goal-based budgeting and promotes mindful spending habits.

- Personal Capital: Offers a holistic financial picture, including budgeting, net worth tracking, and investment analysis.

Embrace Financial Empowerment

By taking control of your finances, you gain the power to pursue your dreams. These budgeting hacks and resources are your tools to navigate your financial journey. So grab your metaphorical tightrope and prepare to walk with confidence towards a brighter financial future!